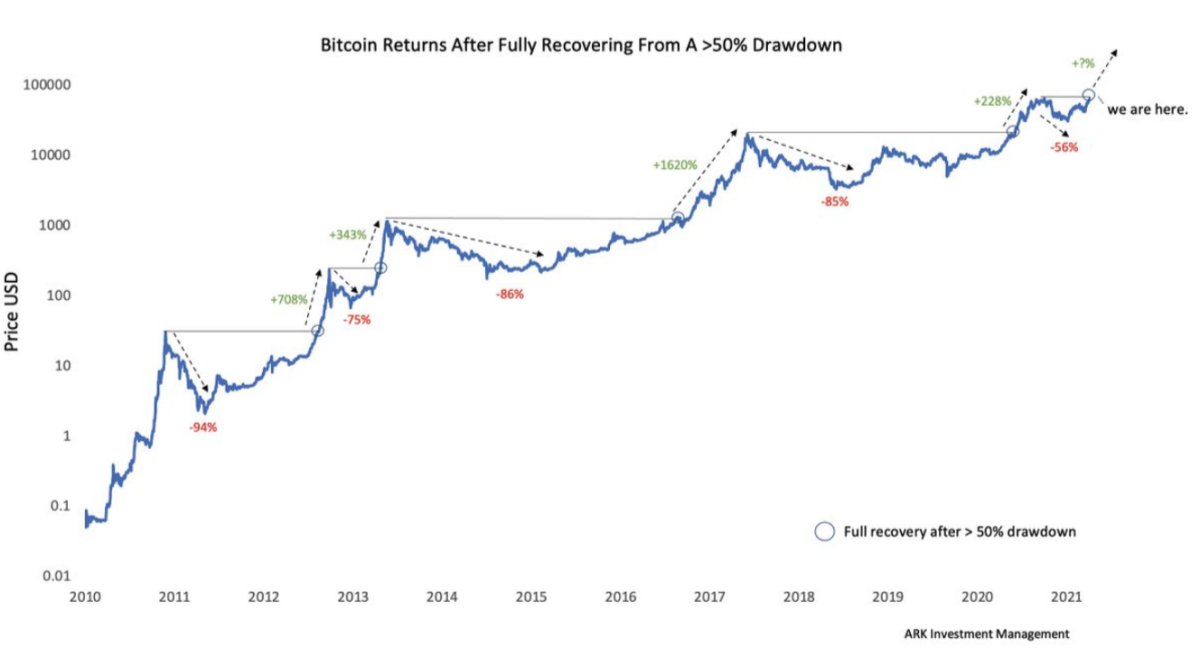

As the majority of bitcoin owners are aware, price declines of more than 50% have been a common occurrence following each all-time high. What we do know is that bitcoin’s price has consistently recovered strongly after severe declines, making it the top performing currency over the last decade. Because of this, a lot of investors are speculating that the price of bitcoin could reach six figures.

We are currently recovering from a 56 percent price decline following a 228 percent recovery. What follows historically is another tremendous rebound.

👀 Bitcoin’s Pattern

This double top pattern is remarkably similar to that of 2013, when price exploded ten times in just 52 days beginning in early October. At $66,000, a six-figure bitcoin price is just a 51% price increase away. According to historical cycles, this is a more conservative percentage movement during a bitcoin bull market recovery.

While history does not always repeat itself precisely, all on-chain measures, recent price action, and forecasts of new entrant demand during the most optimistic holder behavior in bitcoin’s history have suggested the start of a significant price recovery.

At its heart, bitcoin’s price is a result of fresh demand generated by rising adoption relative to the market’s finite supply.

And, at the moment, there is simply not enough supply here on the market until present bitcoin holders discover a new, higher price at which to sell.

This is the result of bitcoin’s free market, volatility nature, which so many criticize. Except that this time, the volatility is in the form of price erupting to the upside, as it has done in each previous cycle.

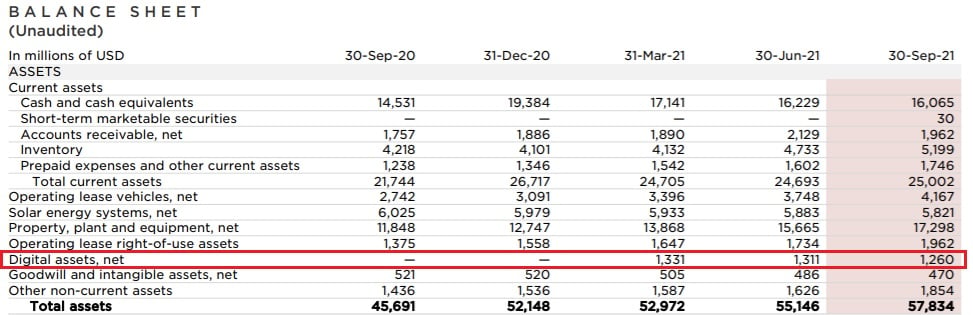

📈 Tesla Hodls Bitcoin in Q3

Tesla, Elon Musk’s electric car business, presented its third-quarter earnings report on Wednesday. The corporation generated sales of $13.757 billion, a 57 percent rise over the same period previous year. “The third quarter of 2021 was a record quarter in numerous ways,” it stated. “We earned our highest net income, operational profit, and gross profit in history.”

Tesla’s balance sheet as of Sept. 30 shows net digital assets at $1.26 billion, down from $1.311 billion at the end of Q2. Tesla announced a $51 million impairment related to bitcoin in Q3.

Tesla’s cash flow statement continues to reveal that the business’s sole BTC purchase and sale occurred in the first quarter, when the company purchased $1.5 billion in bitcoin and traded $272 million in BTC.